Steve Greenfield of Automotive Ventures is always on top of what’s happening in the automotive industry and has named ATC as a “Must-See Company” at the 2021 Virtual NADA Show, the industry’s top marketplace of products and technologies.

“I really like ATC because they solve some of the hardest problems in digitizing dealership workflows focused specifically at enabling online transactions,” said Greenfield, an automotive industry veteran.

Automotive Ventures is the leading resource for automotive technology entrepreneurs. It is always researching and introducing the industry to companies that offer unique services and technology. It is a well-known and respected authority in the areas of technology investments, mergers and acquisitions, investment banking, and growth strategies for companies for the automotive industry.

“2020 was a challenging year for the entire industry,” says Marcus Alley, VP of Strategic Initiatives, “But challenges lead to opportunities, and 2020 was a busy year for ATC. We launched several new services, including the ATC AGF API, which allows automotive businesses of all types to access our industry-best database of tax, title & license information. The ATC AGF API allows digital retailers, desking tools, auto lenders, insurance providers, and Dealership Management Systems (DMS) to calculate all in-state or out-of-state taxes and registration fees in real-time for any jurisdiction in the US. We also introduced innovative pricing and usage models, all of which are meant to help our clients process more transactions.”

“It is incredibly rewarding to have Automotive Ventures recognize that fact by naming us a ‘Must-See Company at the 2021 Virtual NADA Show.’ As one of only 20 companies to make the list, we know we’re in good company!”

To view the video, just click HERE

ATC provides dealers, lenders, and auto technologies accurate TT&L data for in-state and out-of-state vehicle title and registration. For more information about how to create a better, seamless offline to online experience, feel free to reach out to [email protected].

Centennial, CO — (December 9, 2020) – Automotive Titling Company, LLC (“ATC” or the Company), the leading provider of out-of-state tax, title, and registration (“TTR”) software, data, and services for the automotive industry, has received a strategic growth investment from the Polaris Growth Fund (“PGF”). PGF is a software-focused, specialized affiliate fund of Polaris Partners, a Boston-based private investment firm with two decades of technology investing experience.

ATC was founded in 1972 and purchased by CEO Ken Alley in 1996. The Company offers technology enabled full-service out-of-state TTR transaction processing services to dealerships as well as an API that integrates with online applications for any automotive ecosystem vendor. The Company has developed a proprietary database that contains 17 million unique TTR combinations covering all of the 10,000+ tax jurisdictions in the U.S., making ATC the most comprehensive and only independent platform available. Approximately 1,000 dealerships across the U.S. rely on ATC to process their out-of-state transactions throughout the country. ATC also seamlessly integrates this data with dozens of automotive ecosystem vendors, including digital dealerships and retailers, automotive credit providers, loan aggregators, and many others.

Ken Alley, Chief Executive Officer of ATC, said “Our team is eager to partner with Polaris during this exciting time for our company as we continue to provide the highest quality service, support, and data solutions for our customers throughout the automotive ecosystem. We are uniquely positioned to provide the highest quality data in real-time for any automotive transaction in every jurisdiction in the U.S. and we look forward to continuing to improve our database and tech-enabled service offering with the support of the team at Polaris.”

“ATC is the clear leader in out-of-state TTR solutions and is driven by the team’s dedication to providing the most comprehensive and accurate database with the highest quality service and customer support in the industry. This is evidenced by their consistent growth and strong customer retention and satisfaction.” said Bryce Youngren, Managing Partner at PGF, who will join the Board of Directors.

Mark Jacobson, a Vice President at PGF who will also join the Board, said “We are excited about the opportunity to work with Ken and his team to further serve their customers with continued technology advancements, new product offerings, and strategic acquisitions.”

Here at ATC, we know how important it is to feel a part of something bigger than yourself. We have a deeply-rooted understanding of what it means to come together as a team and accomplish something great, as that is really how ATC started back in the early 2000’s. Starting as a small (but mighty!) team, and having grown to more than 34 employees, we know that alone, we accomplish little, but coming together we can truly make an impact.

Our quarterly staff corporate social responsibility (CSR) initiative was no exception to this. On Friday, October 23rd, we proudly held a community blood drive partnering with Vitalant Blood Donation Services, knowing that now, more than ever, there was a great need for blood donations. We had approximately 21 blood donors and collected more than 20 pints of blood. The simple act of ATC coming together to donate blood was in and of itself meaningful, but there was an even deeper connection to why we chose this organization. Eileen, our new Employee Success Manager, found out first-hand the true gift of blood donations.

Eileen was 29 at the time and was pregnant with her first child. Her excitement was quickly replaced with fear when she began experiencing major complications during the birth, eventually leading to an emergency blood transfusion after her kidneys failed. She took five bags of donated blood, bags that saved her life. It was in that moment that she understood what a simple, but truly impactful, act it was to sit in a chair and donate blood that could so easily be the reason someone gets another chance at life. Eileen and her husband now have two sons, age 10 and 8, and with each birthday that passes, she realizes what a gift those blood donations were. They have allowed her to experience the joys of life in Colorado – hiking, skiing, mountain biking, and camping with her family.

Whether it is sitting in a chair for ten minutes donating blood or participating in another corporate social responsibility initiative, our ATC team is always willing to be a part of making a difference.

Learn more about ATC at https://autotitling.com.

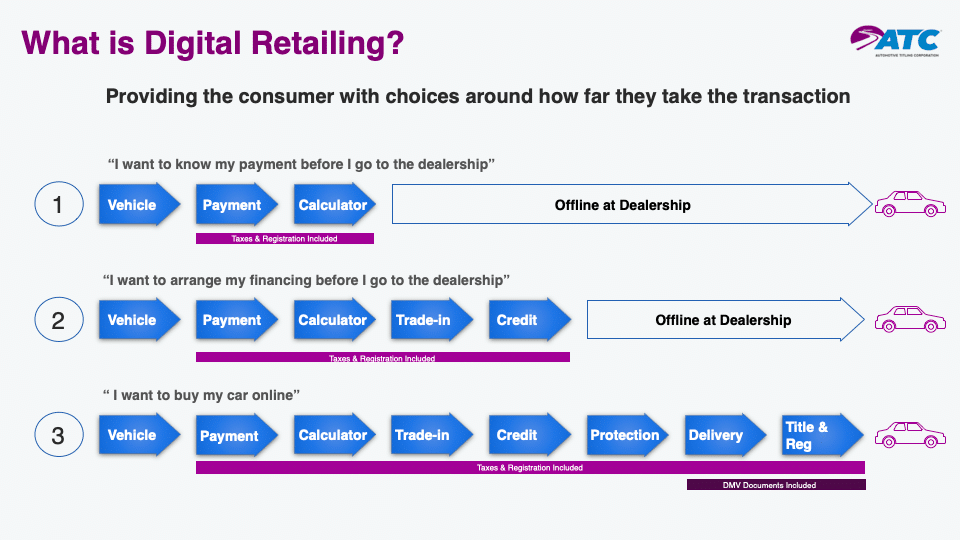

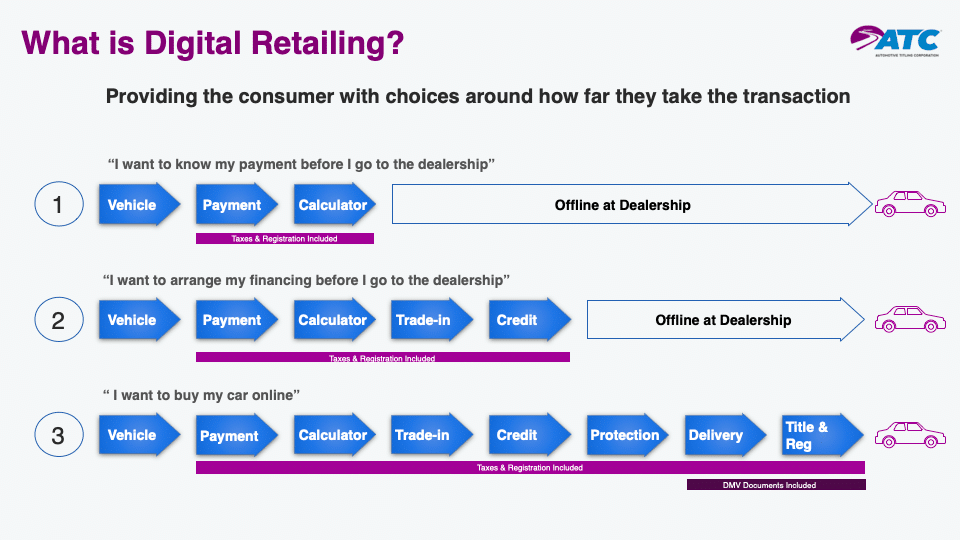

Tax, Title and License (TT&L) is complex but is a very important component of the car buying process, because it is often the last experience a consumer has with the dealership. If this part of the deal goes wrong, it can affect the customer’s perception of the dealership, which factors heavily in their likelihood to return for service or their next vehicle purchase.

To create a positive buying experience, dealers, lenders, and auto technologies can no longer provide inaccurate DMV calculations. Rather, they must source accurate TT&L data and present it accurately throughout the entire buying process so there is complete transparency and no surprises. Consistency, accuracy, and transparency build consumer trust.

Inaccurate tax or fees estimates can cause a deal to disappear if unexpected fees are made aware to the consumer at the last minute or when they register the vehicle at the DMV. Plus, the titling process can slow down and drag out the transaction if the proper documentation is not collected at closing.

If you simply estimate taxes or title and license fees based on the same formula or a state average for every transaction or purchase type you will contribute to a bad customer experience. Many factors influence taxes and fees. For example, in the state of Colorado, knowing if a customer lives inside or outside city limits is important. In the state of Michigan, length of registration is based on the owner’s birthday. In many states the weight of the vehicle is critical to calculate registration fees correctly.

There are additional complexities to consider. For example, using just a ZIP Code to calculate taxes and registration fees does not give you accurate data because postal codes do not follow state, county, and city combinations. Another common mistake often made is the lack of differentiation between in-state and out-of-state transactions. In most states, the TT&L calculation will be incorrect when using in-state rates for an out-of-state transaction.

Buyers can find the vehicle they want online and buy it anywhere. What cannot be bought online is the service that comes along with their vehicle purchase. It is critical that the information consumers get online is consistent with their offline experience when they get to the dealership or take delivery of the vehicle. Accurate Tax, Title and License (TT&L) can be one of the customer experience components that differentiates dealerships.

As the number of online vehicle sales platforms increases, it is important to help both buyers and sellers build trust and confidence in the transaction. Buyers need to know what fees they will need to pay when registering a vehicle at the DMV. Sellers need to know what documents they are required to provide during the transaction. Having this data, and it being accurate, can improve the process and protect both sellers and buyers.

ATC provides dealers, lenders, and auto technologies accurate TT&L data for in-state and out-of-state vehicle title and registration. For more information about how to create a better, seamless offline to online experience, visit us at https://autotitling.com.

Propelled by consumer demand and buying behavior, the auto industry has become more transparent during the entire car buying process. One particular challenge to transparency is showing buyers tax and fee data that reflects what they see on their DMV receipt.

Current solutions have tried and failed to piecemeal accurate data together through third-party vendors, internal teams, and other sources – but still fall short. New companies are created every day to help facilitate transparency with credit pulls, financing, desking, and other tasks, but to this point, no one has been able to accurately mirror a car buyer’s DMV receipt at the time of registration.

Until now.

The ATC Granular Fees (AGF) API was built from the ground up – specifically focusing on DMV receipts in every jurisdiction for each type of transaction. Leveraging over 20 years of expertise in tax title and registration. ATC has real data based on vehicle registration transactions completed at DMVs across the country every day. Our data is arranged in a database that can be easily accessed through an API that provides our customers the ability to configure the granular detail based on use case.

This new API will give our customers the ability to calculate tax rates, taxable value calculations, local flat taxes, and registration fees, at a more granular level to mirror DMV receipts.

The AGF API easily integrates into online applications and allows you to:

- Choose the granular level of fees in the API response. AGF can return over a hundred fees in specific jurisdictions, broken out line-by-line, or rolled up into a single number, All configurable based on your needs.

- See important notes, such as qualifications to receive military waivers and discounts in particular jurisdictions.

Technology has helped us come a long way from the time when the only cars you could buy were the ones on the dealer’s lot! At ATC, we help companies sell more cars to consumers whether they are 2 miles away, or 802 miles away.

For more information about the AGF API, contact us at www.atc-api.com

The people at ATC make us the company we are and help us simplify nationwide auto title and registration so you can sell more cars. We think our people are pretty special, and we’d like to introduce you to Jenny Ward.

How long have you been with ATC?

I have been with ATC for 17.5 years. I started in January of 2003 and two weeks after starting I found out that I was expecting! Things have come full circle because my son Austin has now started working at ATC in our mailroom!

What have you seen change at ATC in your time there?

When I started at ATC we were a very small company looking to grow. Now with more employees and many more customers, our processes have changed dramatically. It has been really neat watching how we have grown while taking on new challenges every day! Something I am proud to be a part of.

What is your favorite thing about working at ATC?

I have worked for Ken (Alley, ATC president) all 17.5 years! He runs a great company, believes in family values, and is very honest, and his company reflects those values. He runs the company very smartly and is always aware of his employee’s well-being, and that is important to him, which does well for the morale in the office.

What are your hobbies outside of ATC?

I enjoy any family and friend time I can get. Life is short and you never know how much time you will get with loved ones, so I do not take that for granted. I love to hike and be outdoors with my family. As for free time… Ask me again when my kids have grown!

Before working at ATC, what was your most interesting or unusual job?

The job I enjoyed the most was teaching swim lessons and being a swim coach. I loved working with and getting to teach the kiddos in the pool!

What is the best vacation you have ever been on?

We took a family cruise last summer to the Bahamas. It was my son’s very first vacation! It was so special for me to finally be able to take him on a trip! Memories to last a lifetime!

What interesting tidbit do you want ATC customers to know about you?

I love kids, animals and family and friends. I love to sing! I love to just enjoy what life has to offer.

With great people like Jenny on the ATC team, we can provide our customers the high levels of service they’ve come to expect. When you work with ATC, Jenny, among others, will always make sure that your title and registration work is done correctly and efficiently. And if you’re lucky, maybe she’ll sing for you!

Here at ATC, we’re often asked: “Can I just use a ZIP Code to calculate vehicle taxes and registration fees?” The short answer to this question is “Not if you want accurate results.”

ZIP Codes are an easy data point to capture from consumers, but this is just the starting point when it comes to calculating title and registration fees for motor vehicles. Did you know that ZIP Codes are actually a United States Postal Service designation? ZIP Codes help the post office deliver your mail, but they don’t necessarily follow tax jurisdictions. Tax jurisdictions are determined by local governments and normally consist of a state, county, and city combination the local DMV uses this to calculate taxes. The footprint of a ZIP Code often spans multiple cities or counties – this can be a problem when calculating taxes and fees.

Tax and registration fee calculations are complex! The more information a consumer provides, the more accurate the tax and fee calculation will be.

But what if I only have a ZIP? We can help. Our API includes a tool to help translate from ZIP Code to tax jurisdiction. The ZIP Code decoder will return all the state, county, and city combinations based on the input ZIP Code. This means you can better calculate the taxes due and easily identify the “next level” information needed from the user.

When the ZIP Code is entered by the end-user and our API returns multiple outputs, the best practices are to verify the consumer’s state, county, and city. At ATC, we understand that user intervention is not always an option in the digital world. Our clients handle this in a few different ways. In cases where a ballpark estimate of taxes and fees is fine, some clients choose to display the taxes for the first combination returned. In this case, we recommend including a notation that the fees may not be accurate if only a ZIP Code is entered. Other clients provide a range of values based on the possible jurisdictions. Finally, some clients have a dynamic service where the more information a user provides, the more granular the response becomes.

For more information about how ATC can help you by providing the most accurate tax and registration fee data, contact us at https://atc-api.com/.